It has been a tough few months in Sydney with lockdowns keeping people at home and bunkered down – but that started to end on “Freedom Day”, Monday 11 October, 2021. And common wisdom suggests there is no further political will for future lockdowns of this scale and size. We have hit some impressive vaccination rates and the freedoms that have been delivered are a just reward for so many of us rolling up our sleeves.

Still, there remains a degree of anxiety with many concerned about what’s in store over the coming months both on the health front and economically. A natural human response in times of crisis can be to go to ground and wait for the storm to pass. For some would-be property buyers, there will definitely be a feeling that the wait-and-see approach is the most prudent. While I understand this desire, it would be a huge mistake for Sydney property buyers to do this now.

According to my research, the post-lockdown market is most likely to strengthen. In fact, buyers should be as active as ever right now, rather than putting off their purchases.

Here is why.

History

History tells us that property is one of the most resilient asset classes in Australia. It is obvious that when the going gets tough, the tough seek property.

According to Domain, in September 2008 when the GFC was well and truly underway, Sydney’s house price growth dropped into negative territory. However, as interest rates fell, the recovery hit full swing and price growth bounced back to positive, reflecting 15 per cent in gains by March 2010.

The real money has been made by those who have held long-term. ABS data shows Sydney’s median house price in 2008 was around $500,000. By 2019 it was approximately $1.1 million. That’s a 120 per cent gain in 12 years. Certainly, enough to offset any GFC losses.

But it’s not just long history proving values will bounce back fast. Lockdowns in 2020 were apparently set to deliver medium-term price contraction of 15 to 20 per cent – depending on which economists you asked. How did that play out?

Well, according to the latest CoreLogic data, the 12-month house price growth for Sydney to the end of August 2021 has been 20.9 per cent. And we know the reason. Sellers pulled their properties from the market and listing numbers dried up. While there may have been buyers expecting a bargain in mid-2020, they couldn’t find anything to purchase.

So, values remained resilient. And this is exactly what we are seeing now. Listings are tight and prices are rising.

Too big to fail

We have also witnessed first-hand how the importance of Australian property to the economic health of this country translates into decisive government assistance when needed. A range of schemes such as HomeBuilder and early superannuation withdrawal demonstrate the Federal Government’s commitment to strong economic conditions. State politicians also implemented new legislation that both protected tenants and gave certainty to landlords.

Even the private sector has done its bit. Lending institutions issued mortgage holidays and adapted loan arrangements to ensure foreclosures were avoided.

Not to mention the RBA who have maintained the lowest cash rate in history. Of course, some are now asking, ‘Is the market too hot?’ There was one minor response to this last week when the banking regulator directed lenders to increase their interest rate buffers. Loan applications are now being stress tested at 3.0 per cent above the applicable interest rate, rather than 2.5 per cent.

But other than this directive – which will hardly dent the enthusiasm of solid borrowers – there has been little appetite to stymie the market.

There seems to be, in fact, a common goal across the political and financial spheres to ensure that property will remain price resilient

Smart minds agree

Most economists believe that while activity slowed a little during the lockdown and may take a moment to recover in the coming weeks, it will be a blip on the chart compared to long-term results.

A recent report by the ANZ titled Housing: Delta unlikely to derail strength sets out the case.

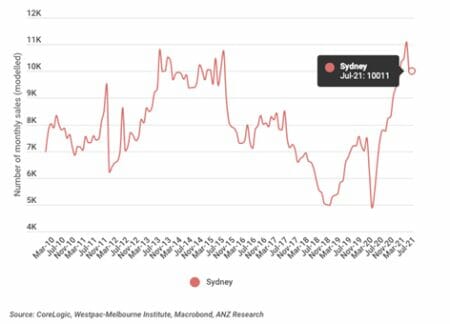

Despite the lockdowns, Sydney sales volumes remained high at around 10,000 sales per month – the highest number since 2015/16.

ANZ also note that housing finance rose 83 per cent in the year to June 2021, and construction activity has rebounded sharply.

Their call is simply:

“The housing sector remains in very good shape. National house prices continue to rise strongly, even in Sydney where increasing levels of mobility restrictions have been in place since June in response to the rising number of Delta COVID cases. Ultra-low interest rates, high savings buffers and ongoing fiscal support are likely to continue to support the market.”

So, anyone looking to buy a property should move boldly forward. All the evidence shows that acting now will stop you being priced out of the market in the months to come.

For anyone thinking of buying their new home or investment property in Sydney, get in touch with us today.