Marrickville, located in Sydney’s vibrant Inner West, has long been celebrated for its blue collar background, eclectic culture, strong community ties, and desirable location approximately 7km from the CBD. However, with median house prices currently hovering around $2 million and units averaging $893,500, many property buyers are questioning whether Marrickville has become overpriced or if it remains a sound investment opportunity.

To answer this, we must evaluate Marrickville’s current property market dynamics, affordability relative to other Sydney suburbs, and the factors influencing future growth.

Marrickville’s Current Property Market

The property market in Marrickville has experienced significant growth over the past decade, driven by ongoing gentrification, infrastructure upgrades such as the Sydney Metro extension (due to open later this year), and its appeal as a lifestyle hub. As of early 2025:

- Median House Prices: Marrickville’s median house price stands at approximately $2.04 million, with larger homes exceeding $2.5 million (Source: realestate.com.au).

- The Marrickville Record House Price: Currently stands at an eye watering $6m which was achieved by Alex Mastoris of Cobden & Hayson for the sale of 148 Livingstone Road on 6 September, 2024 (Source: realestate.com.au).

- Median Unit Prices: Units are significantly more affordable, with a median price of $893,500 (Source: realestate.com.au).

- Rental Yields: The average rental yield for houses is 2.6%, while units offer slightly higher returns at 3.2% (PropTrak).

While the median figures are high compared to historical data, they reflect broader trends in Sydney’s Inner West, where demand consistently outpaces supply due to limited land availability and high desirability.

Affordability Concerns

Affordability is a pressing issue for property buyers in Marrickville. Rising interest rates and sustained price growth have made it increasingly difficult for first-time buyers and middle-income families to enter the market.

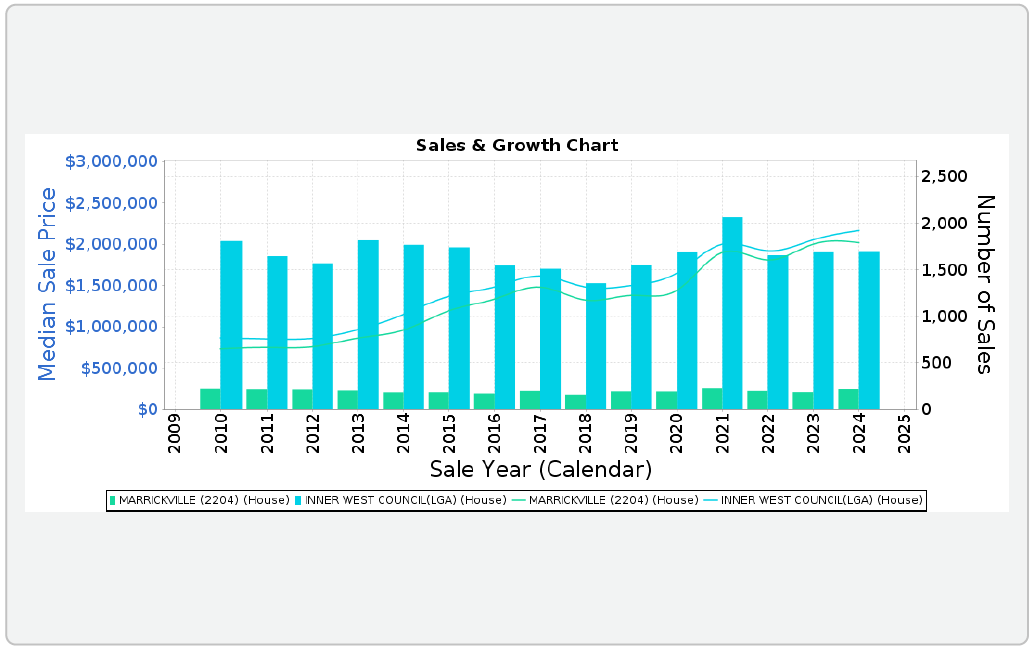

- Comparison to Other Suburbs: Marrickville’s median house price is more affordable than other Inner West suburbs such as Summer Hill ($2.35 million) and remains well below premium areas such as Haberfield ($2.7%). This still positions Marrickville as a more attainable option within the Inner West. See the graph below sourced from Pricefinder which tracks the median growth rate over the last 10 years comparative to the Inner West LGA more generally. This suggests that Marrickville prices have actually become more affordable than the rest of the LGA over the past 18 months.

- Economic Pressures: Higher borrowing costs have reduced purchasing power for many buyers. However, the interest rate cuts later of 2025 could improve affordability and boost demand.

For those seeking value in Marrickville, smaller properties or units may offer a more accessible entry point into this sought-after market.

Is Marrickville Overpriced?

Determining whether Marrickville is overpriced requires examining its value proposition relative to current market conditions and future growth potential.

Factors Supporting Current Prices

- Infrastructure Upgrades: The extension of the Sydney Metro City Line to Marrickville will significantly enhance connectivity, increasing the suburb’s appeal for commuters and investors alike.

- Strong Demand: Gentrification has transformed Marrickville into a cultural hub with new library, trendy cafés, boutique shops, and vibrant community spaces. This lifestyle appeal continues to attract professionals and young families.

- Limited Supply: Heritage preservation laws and tightly held housing stock constrain new developments, keeping supply low and prices stable.

Challenges to Sustained Growth

- Affordability Pressures: With median house prices exceeding $2 million, many buyers are priced out of the market. This could dampen demand if economic conditions worsen.

- Potential Market Corrections: Some analysts predict minor price declines in Sydney’s property market during the first half of 2025 due to affordability constraints and the continued impact of higher interest rates. However, any downturn is expected to be short-lived once the benefit of interest rate cuts is felt.

Opportunities for Property Buyers

Despite high prices, Marrickville remains an attractive option for certain buyer demographics:

- First-Time Buyers: Units offer an affordable entry point into the Inner West market. Buyers’ agents can help identify off-market opportunities or properties with renovation potential to maximise value.

- Investors: Strong rental demand and proximity to transport hubs make Marrickville a solid choice for long-term capital growth. Boutique apartments near amenities and the transport hubs are particularly promising.

- Families: Freestanding houses with renovation potential provide opportunities for families seeking larger homes on bigger blocks within reach of schools and parks.

Future Outlook

Marrickville’s property market is poised for continued growth over the long term due to several key factors:

- Population Growth: Sydney’s population is expected to increase significantly over the next decade, placing further pressure on housing supply in desirable suburbs like Marrickville.

- Infrastructure Investments: The completion of major transport projects will enhance accessibility and drive demand for properties near Metro stations.

- Shift in Buyer Preferences: As affordability remains a challenge across Sydney, more buyers may turn to apartments as a cost-effective alternative to houses.

However, short-term fluctuations are likely as the market adjusts to interest rate changes and broader economic conditions.

Conclusion

While Marrickville’s property prices may seem high compared to historical levels, they reflect its enduring appeal as one of Sydney’s most vibrant Inner West suburbs. For well-informed property buyers working with experienced buyers’ agents, Marrickville offers opportunities for both lifestyle benefits and long-term capital growth.

That said, affordability pressures mean that buying a property in Marrickville is not without financial risks—particularly for those stretching their budgets in today’s high-interest environment. Prospective buyers should carefully assess their financial capacity and consider leveraging professional guidance to navigate this competitive market effectively. Before buying a property in Marrickville or indeed anywhere, you should always check whether you can find better value for money elsewhere.

At Buyer’s Domain, we specialise in helping clients secure properties that align with their goals and budgets. Whether you are looking for your dream home or your next investment opportunity in Marrickville or beyond, our tailored strategies can help you achieve success in Sydney’s dynamic real estate landscape.