Auction clearance rates are often reported on in the media. Experts in the property industry rely on these statistics to make predictions about the market. This is because auction clearance rates, if understood correctly, can be one of the best leading indicators of the performance of the property market. Let’s explore why auction clearance rates are popular and how buyers can use the data to their advantage.

What do auction clearance rates mean? Why are they important?

The auction clearance rate is the proportion of properties that sell at auction, expressed as a percentage out of the total number of properties put up for auction on a given date. The auction clearance rate is typically reported on a weekly basis and it is more commonly reported on in the capital cities of Sydney and Melbourne where sale by auction is a very common method of sale.

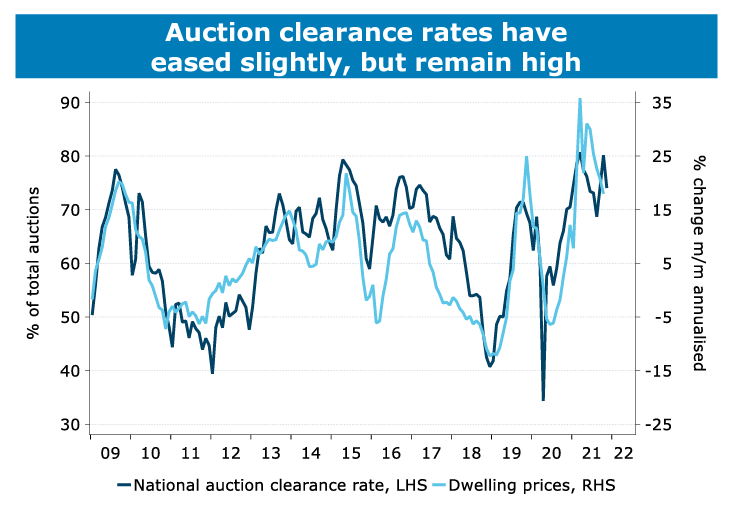

The auction clearance rate is a valuable source of information because it is a leading indicator of the performance of the property market. It provides clues as to how prices are likely to change because the clearance rate measures the supply and demand in the market and there is usually a strong correlation between clearance rates and property prices. Over time, it is possible to spot and track trends.

How to interpret auction clearance rates

Auction clearance rates tell a story; the higher the auction clearance rate, the higher the volume of properties are selling at auction which in turn means that there is a higher level of buyer competition which drives up property prices. The reliability of auction clearance rates as a predictor of property prices is strengthened because auction clearance rates are tracked weekly.

As a rule of thumb, it is universally accepted that auction clearance rates of around 60% indicate a balanced market, clearance rates above 70% indicate a seller’s market and a clearance rate below 60% signals a buyer’s market.

To illustrate, here is the close relationship between auction clearance rates and property prices nationally:

Image source: ANZ Research Australia’s Housing Rolling Over

The limitations of auction clearance rates

Clearance rate data does not include all property sold in the market. The clearance rate only reports on properties advertised with an auction campaign and does not include properties which are listed for sale by private treaty. Another limitation of the clearance rate is that while auctions are common in Sydney and Melbourne, auctions are not as popular in other cities, which limits the availability and reliability of data. And lastly, auction clearance rates vary depending on which data house you are sourcing the information from. This is likely due to differences in how the auction clearance rate is calculated and when the results are published.

How can buyers use the auction clearance rates when assessing individual property?

Auction clearance rates at the capital city or regional level are useful as a barometer of broader buyer demand. However, at the suburb level, the data can become less reliable with smaller datasets. Buyers can build their own micro auction clearance rate analysis based on their own property criteria, if they are willing to put in the work! For example, if you are searching for a 3-bedroom house in Glebe-Haberfield, check out all of the properties that meet the brief or thereabouts, track their performance; attend the auction and watch how many people are registering and where the bidding starts/finishes/passes in. This information is gold when negotiating on a property.

Data is extremely important when assessing how property prices will perform in the market and auction clearance rates are one of the key measures to help buyers understand the level of competition they will likely face. However, auction clearance rates as reported in the media are on a national or metro level and so are general only in relation to a specific property search. When searching for property it is imperative for buyers to examine the property market at a granular level and develop a deep understanding of the recent sale prices of properties in the same area that are similar to their own brief. Only then will buyers understand what it will take to be competitive and successful in the property market.

If you are overwhelmed by the level of information and data when conducting your property research or you are struggling to find the right property for you, email us today at nick@buyersdomain.com.au.